BLUF - Bottom Line Up Front

BLUF - Bottom Line Up Front

Vendor risk management is crucial for overseeing third-party data access, especially as risks from vendors have grown. Only 52% of firms have strict access rules, leading to security breaches like those at Home Depot and Target. Important strategies include centralizing the risk management process, continuous monitoring, and using a standardized risk assessment. Compliance software helps manage these processes, offering automation, machine learning, and diverse pricing options to fit business needs and budgets.

Vendor risk management is the practice of governing third-party access to company data. This is a critical aspect of an organization since vendors view your business information when providing their services. For some, this can turn into a severe vulnerability that can lead to data breaches. In fact, in the past five years, vendors like Home Depot and Target were responsible for those incidents, as reported by Forbes.

It is imperative that businesses revisit their vendor risk management programs since risks associated with third-parties are growing continuously. Despite that, only 52% of businesses have rules for third-party access to their systems. Access by vendors to organization networks has grown in the past two years, according to 75% of businesses. On top of that, FRSecure cites that 69% of survey respondents said their companies positively experienced security breaches because of third-parties in the previous year.

While trustworthy security software can offer huge help in protecting the company’s records against hackers, spies, and other illegal access, it is still critical that businesses are proactive in removing agents that pose security risks to them.

Compliance management platforms that help in compliance tracking can help in this regard. Solutions of this nature help centralize vendor risk management, promotes continuous vendor risk monitoring, and standardizes vendor risk assessments. These three are actually prevailing trends in vendor risk management. These are assisted by technologies embedded in solutions and their processes are simplified because of those innovations.

Let’s take a look below how state-of-the-art technologies can transform vendor risk management.

1.Centralized vendor risk management

In vendor risk management, it is now becoming more important to centralize the process. Companies are realizing that silos are only impediments and are breaking down those walls to increase invisibility across the board. Doing so also eliminates redundancies and allows teams to examine their needs and their vendors. With the latter, it is even possible to reduce the number of third-parties, thus leading to higher cost-savings.

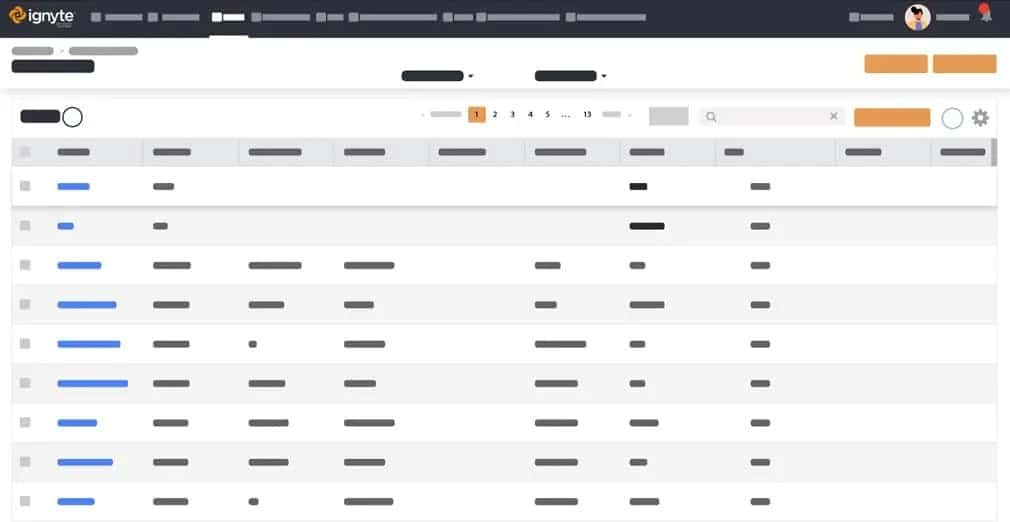

How can companies do and achieve those things? Compliance management software can help. Its onboarding facility enables businesses to register their vendors to a single platform. This way, the centralization process can begin.

The onboarding feature is accessible to vendors themselves as well. They can register as a third-party without intervention from the vendor management team, further streamlining the process. On top of that, the system puts into auto-pilot mode the assessment process as well as the cyber risk scoring. With this, it is easy for the vendor risk governance unit to evaluate vendors and vendor applications.

They no longer have to shuttle between different software screens to complete their tasks so they can provide answers to would-be vendors immediately. Furthermore, this is advantageous to the rest of the organization that require assistance from a vendor in carrying out their responsibilities.

2. Continuous vendor monitoring

Vendor risk assessment used to be done upon application and onboarding. However, there has been an increased need for security. To that end, businesses are putting into effect continuous vendor monitoring.

Aside from automation, compliance monitoring tools are also utilizing machine learning for smarter evaluations. Third-party relationships change over time and it is critical to assess their standing with the organization periodically to protect from data breaches. With machine learning, analysis of the relationship between the vendor and the organization can be done quickly.

This technology also allows for adaptive risk management, enabling decision-makers to make real-time choices.

3. Standardized risk assessment

Most companies would use their own methodologies for assessing the risks third-parties pose. But now, there is a trend towards a standardized risk assessment framework. While there is no one standard yet, there are common templates in use in organizations widely.

With this, it is easier for your compliance management system’s artificial intelligence engine to evaluate answers and make comparisons. With a standard, it is easier for risk comparisons to be accurate as well. This is possible, as the risk assessment solution can work with a uniform set of data.

Getting onboard the risk management practice

Small and medium businesses may have limited dealings with vendors but when they have access to internal systems, managing the risks they pose and monitoring their compliance with the data access and usage rules are important. This way, companies can protect themselves as well as their customers. The safeguarding of clients’ interests is critical as losing their trust could mean the loss of business. Budget is not even a major issue as compliance software pricing comes in various tiers that can fit any business size.

How can organizations ensure the privacy and security of their systems whilst making it easy for vendors to access necessary data?

Vendor management solutions are an answer. Yet the first step any business has to take before signing up with software is to look at compliance software prices and comparing them. This can vary enormously depending on the features and services offered by the vendor so it is important that businesses evaluate their needs carefully. Thus, they can be successful in curbing the risks posed by third-party access without going over the budget.

BLUF - Bottom Line Up Front

BLUF - Bottom Line Up Front